Acquiring property in Cyprus, either as an investment or as a second home, has always been a popular choice among foreign investors.

ABOUT

Cyprus Real Estate

A combination of high quality of life, year round sunshine and natural beauty, ease of doing business and investment incentives, offers investors an attractive experience in terms of both living and doing business.

Property sales have increased significantly in 2018, with the construction industry intensifying its activities island-wide.

Cyprus continues to offer unique options for beautiful holiday homes and represents a popular destination for permanent residency and retirement.

Why should you invest in a Real Estate AIF?

Collective Investment

Investing in a Real Estate AIF reduces the burden of the full amount which is required by the investor to make available for the investment, compared to the amount which would normally be needed to be available, if the investor was acting on its own.

Diversification

Concentration risk is limited as AIF pools the money invested by many investors and uses the large mass to buy several properties. This way of investing assigns investors as the owners of units in the AIF.

Protection

All the activities required to manage real estates are performed by the professionals responsible for the AIF. The funds are regulated by a competent authority and property management is performed by experienced professionals.

Transparency

Investors will be updated for the value of investments and the policies of the AIF through the periodic reports that are prepared and circulated to them based on regulatory requirements.

FACTS AND FIGURES ABOUT

P.L. Property Gallery Fund

A Cyprus city-based real estate strategy that seeks to achieve superior returns and maximum capital appreciation.

P.L. Property Gallery Fund Ltd.

Open ended.

Limited Liability Company.

75 (Seventy Five) investors.

Unlimited.

EURO.

Property Gallery Investments Sub-Fund One.

Cyprus

If appropriate development opportunities arise, the Board of Directors shall place its focus in other markets.

3 Years.

Worldwide except U.S. Investors

Equivalent EUR 125.000

Equivalent EUR 125.000

30.06. and 31.12.

Semi-annually

0.5% p.a.

Equal to 20% of the

in the NAV of the Fund above the high watermark threshold and a Hurdle Rate equal to 7%

100 EURO (Redemption Fee: None).

Dividends will be payable to the Investors upon the Directors discretion.

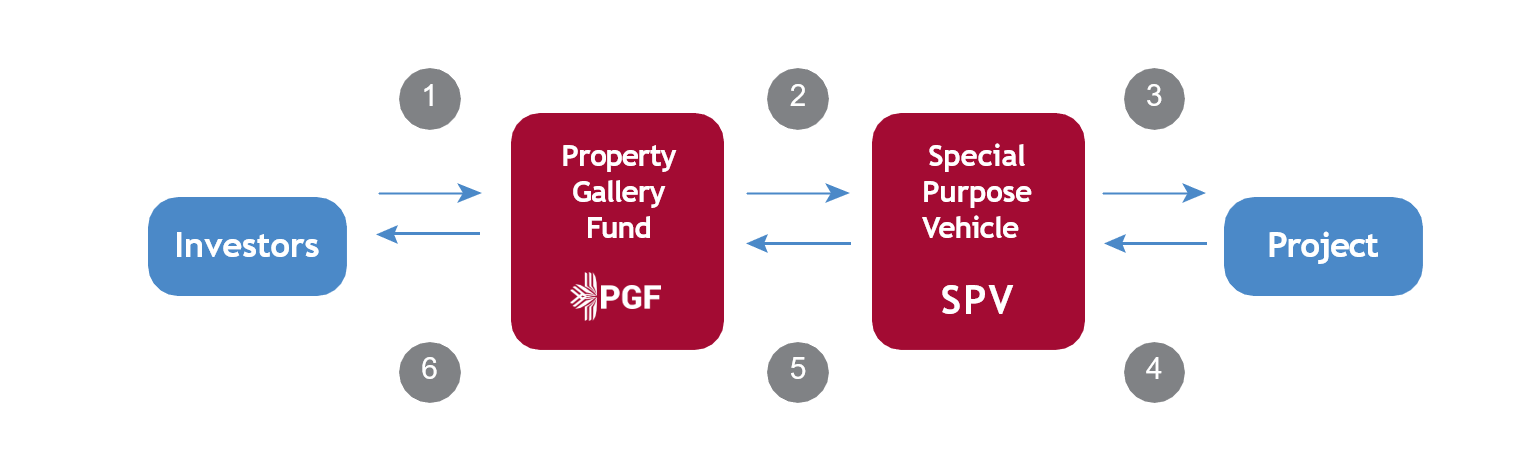

INVESTMENT STRUCTURE

- Investors subscribe to the Fund and receive shares of the Fund

- The Fund or Sub-Fund purchases shares of the SPV.

- The SPV invests in the Project.

- The SPV receives rent or proceeds of sale

- The SPV distributes dividends to the Fund.

- The Fund distributes dividends to the unit-holders.

Investment Process

- The Directors will carefully select a limited number of potential projects by adhering to a thorough investment process that includes extensive due diligence and market research.

- The Directors will aim to engage leading local law firms to perform the legal due diligence and draft all the investment documents, as well as leading accounting firms to undertake the required accounting and financial due diligence. Subject to completion of satisfactory due diligence, the Board will approve the investment opportunity.

- The Investment Compartment intends to have control over the majority of Projects in which it invests and when the Board deems appropriate the Compartment may invest in non-majority projects, as a minority shareholder.

- The Directors take a hands-on management approach, in close collaboration with its partners to create maximum value throughout the development and realization process by utilising its financial skills and access to an extended network of debt providers and real estate specialists.

Risks

Such risks include, but are not limited to:

- Unfavourable changes in asset prices

- Reduction in real estate prices

- Tenant’s risk

- Vacancy risk

- Competition risk

- Rental prices risk

- Liquidity of property assets

- Development risks

- Environmental risks

- Management risk

- Non-diversification risk

Investment Opportunities

We have a strong pipeline of opportunities, allocated in the related party Property Gallery Developers and Constructors Ltd

NEREUS TOWER OFFICES FOR SALE

Description

Mixed-use building comprised of large shop, 2 office floors and 2 whole floor apartments. Sea front

Location

Main coastal avenue of Germasogia tourist area, Limassol

Ownership

Free-hold

Current Stage

Under Construction

Construction Period

12 months

Project Cost

€ 8.000.000

Total Plot Area

2.415 m2

Total Development Area

1.727m2

LUXURY VILLAS FOR SALE

Description

16 Luxury Villas

Location

Mountainous area of Limassol

Ownership

Free-hold

Current Stage

Off-plan, All permissions granted

Construction Period

30 months

Project Cost

€ 32.000.000

Total Plot Area

24.923 m2

Total Development Area

11.770 m2

PINERIDGE RESIDENCES, MIXED USED

Description

45 Luxury terraced apartments and town-houses

Location

Hilltop of Pissouri Resort

Ownership

Free-hold

Current Stage

Off-plan, All permissions granted

Construction Period

26 months

Project Cost

€ 8.060.000

Total Plot Area

14.350 m2

Total Development Area

5.250 m2

OFFICES & SHOPS LEASING, LONG TERM

Description

Office building, Retail, Shops, Offices

Location

In the heart of the business centre of Limassol

Ownership

Long-lease

Current Stage

Started construction

Construction Period

24 months

Project Cost

€ 9.000.000

Total Plot Area

1.529 m2

Total Development Area

6.500 m2

Lyra Amvrosidou

Glafkos Mavros

Fund Manager:

P.L. Property Gallery Fund

Bank:

Eurobank Cyprus Ltd

Fund Administrator:

PriceWaterhouseCoopers Fund Services Ltd

Auditor:

Deloitte Ltd

Risk Manager:

Andreas Theodosiou

Internal Auditor:

Christoforos Theodosiou

Compliance Officer:

Nicolas Demetriades

AML Officer:

Lira Amvrosidou

IMPORTANT REGULATORY NOTICE

This document has been prepared by the P.L Property Gallery Fund Ltd (“PGF”) and its agents and consultants. PGF is incorporated and registered in Cyprus with registered office A1 Georgiou street, Monastiraki Centre, Limassol, Cyprus – P.O. Box 52309 – 4063, with registration no.HE363902. PGF is authorised and regulated by the Cyprus Securities and Exchange Commission, with CySEC Licence No. LPAIF49/2014.

The content is provided for information purposes only; it is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. This publication is exclusively intended for Professional and well informed investors only (according to MiFID classification). It does not constitute investment research or a research recommendation. This document has been classified as ‘non-independent research’ and so is considered a marketing communication and is not subject to any prohibition on dealing ahead of dissemination of investment research. This document has been prepared using sources believed to be reliable, however we do not represent it is accurate or complete. In relation to investment propositions, the information provided is not intended to provide a sufficient basis on which to make an investment decision. PGF accepts no liability for any loss arising from the use of this material. Any performance claims or results referred to in this document are not a guide to future performance of PGF or related investments. All investments by way of virtue carry risks, though risk levels may vary. The value of investments can go down as well as up and the implementation of a particular approach described does not guarantee positive performance. Past performance is no guide to future performance. Real estate investments are subject to various risks, including fluctuations in property values, higher expenses or lower income than expected, and potential environmental problems and liability. Please consider all risks carefully prior to investing in any particular strategy. The portfolio’s concentration in the real estate sector makes it subject to greater risk and volatility than other portfolios that are more diversified and its value may be substantially affected by economic events in the real estate industry. All information is as of July 2018 unless otherwise disclosed. For professional and well informed investors use only. Not for use with or distribution to the public.

© 2021 All rights reserved P.L Property Gallery Fund Ltd.